Biobanks Industry Overview

The global biobanks market size is expected to reach USD 100.8 billion by 2030, according to a new report by Grand View Research, Inc., registering a CAGR of 4.6% during the forecast period. Biobanks continue to evolve with the introduction of new technologies, such as NGS, and increased focus on genomic medicine. The availability of several types of biospecimens to cater to multiple domains including drug discovery, diagnostics, and others has accelerated the diversification of biorepositories, thereby driving the market. The quality of biospecimens can significantly influence disease testing as well as preclinical and clinical research. Regulatory agencies have played a vital role in spurring the adoption of biobanking services by establishing guidelines for the effective management of samples.

U.S. Centers for Disease Control and Prevention (CDC) released guidelines to minimize human hazards while handling COVID-19 samples. This serves as a model for other biorepositories. Furthermore, as the number of research studies and clinical trials related to COVID-19 is increasing, the demand for high-quality biospecimens is expected to significantly increase in the near future, leading to market growth. In addition, population-based cohort studies are facilitated by biorepositories to estimate the actual seroprevalence. Health Catalyst, Inc., through its Touchstone platform, provides national data related to COVID-19 insights. Such factors are anticipated to contribute to the revenue flow in this space.

Biobanks Market Segmentation

Grand View Research has segmented the global biobanks market on the basis of product, service, biospecimen type, biobanks type, application, and region:

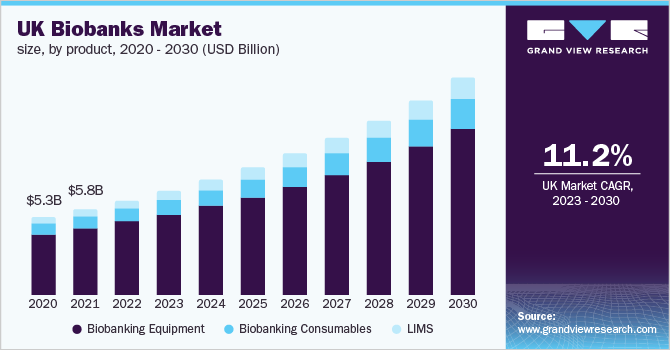

Based on the Product Insights, the market is segmented into Biobanking Equipment, Biobanking Consumables, Laboratory Information Management Systems.

- The biobanking equipment segment dominated the market and accounted for the largest revenue share of 74.0% in 2021owing to a rapid increase in the number of new biobanks and the high cost of initial equipment installation.

- A wide range of equipment is offered to cater to different biobanking processes, such as sample preparation, collection, processing, storage, and shipment.

- The equipment includes cell separators, freezers, thawing equipment, barcode readers, and alarm and monitoring systems.

- The Laboratory Information Management Systems (LIMS) segment is anticipated to emerge as a lucrative source of revenue during the forecast period. This is because LIMS plays an important role in COVID-19 biobanking, testing and research.

Based on the Service Insights, the market is segmented into biobanking & repository, lab processing, qualification/validation, cold chain logistics, other services.

- The biobanking and repository services segment dominated the market and accounted for the largest share of more than 37.00% of the global revenue in 2021.

- This is owing to the higher market penetration of these services and the increased need for the preservation of biosamples for developing precision medicine and disease-specific research.

- The expansion of biobanking services from academic research to include clinical enterprises and government initiatives, as well as highly-networked and open-ended ventures, has supported the segment.

- The lab processing segment is also expected to witness significant growth in the near future and is estimated to account for the second-largest revenue share by 2030. This growth can be attributed to the increasing demand for clinical trials and research-related workflows around COVID-19.

- Many research institutes and companies are engaged in the development of vaccines and research studies for the novel coronavirus. This, in turn, is expected to increase the demand for lab processing services, such as DNA extraction, plasma/serum isolation, sample retrieval, and sample plating, thereby supporting segment growth.

Based on the Biospecimen Type Insights, the market is segmented into Human Tissues, Human Organs, Stem Cells, Other Biospecimens.

- The human tissues segment dominated the market and accounted for the largest revenue share of 37.5% in 2021. This is owing to a large number of biobanks with facilities to store tissues, easy availability of tissue samples, and availability of advanced technology for storage and retrieval of banked tissues.

- Technological advancements, such as the use of 3D-printing for tissue sample/3D-printed mini-organs creation in COVID-19 testing are expected to boost the segment growth.

- The number of established stem cell biobanks has been increasing rapidly worldwide. Promising applications of stem cells in regenerative medicine, cell therapy, developmental biology, toxicology, and drug development can be attributed to the rapid increase in the number of stem cell banks, resulting in the lucrative revenue growth of this segment.

Based on the Type Insights, the market is segmented into Physical/Real Biobank, Virtual Biobanks.

- The physical/real biobanks segment dominated the market in 2021 and accounted for the largest revenue share of 80.4%. These biobanks have a well-established network, thereby holding a high revenue share.

- However, in recent years, virtual biobanks have emerged to address the problems related to the accessibility of biospecimens.

- The potential to fulfill the need for biospecimens and the ability to trace and obtain rare samples improves with virtual biobanking. Also, easy accessibility associated with virtual biobanks contributes to the lucrative growth of the segment.

Based on the Application Insights, the market is segmented into Therapeutics, Drug Discovery & Clinical Research, Clinical Diagnostics, Other Applications.

- In 2021, the drug discovery and clinical research application segment dominated the market with a revenue share of 34.3%.

- For instance, Mayo Clinic has initiated an observational study for prospectively collecting research biospecimens and clinical data from COVID-19 patients, to enable high-quality research, thereby driving the segment growth.

- The clinical diagnostics segment is anticipated to witness the fastest growth over the forecast period. Comparison of biospecimens obtained from healthy and diseased individuals advances the clinical diagnosis process, especially for cancer.

Biobanks Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The increasing availability of biospecimens, the market participants are expanding their offerings to keep pace with the rising demand for bio-storage solutions. For instance, in February 2020, Hamilton Storage launched new sample storage tubes along with RackWare racks at SLAS 2020 International Conference and Exhibition.

Some prominent players in the global biobanks market include:

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- QIAGEN

- Hamilton Company

- Avantor

- Tecan Trading AG.

- Danaher Corporation

- Becton, Dickinson and Company (BD)

- BioCision

- Taylor-Wharton

- Charles River Laboratories

- Lonza

- STEMCELL Technologies Inc.

- Biovault Family

- PromoCell GmbH

- Precision Cellular Storage Ltd. (Virgin Health Bank)

Order a free sample PDF of the Biobanks Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment