Pharmacovigilance Industry Overview

The global pharmacovigilance market size is expected to reach USD 17.36 billion by 2030, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 10.5% from 2022 to 2030. Increasing incidence of Adverse Drug Reactions (ADRs) is the key growth driver. ADR imposes a substantial burden on healthcare systems and is one of the prominent causes of morbidity in developed countries. According to the National Center for Biotechnology Information (NCBI), approximately 5% of total hospitalizations in Europe each year are due to ADR. Pharmacovigilance services play an integral role in this clinical trial phase by assisting manufacturers in identifying adverse effects associated with the drug.

Pharmacovigilance Market Segmentation

Grand View Research has segmented the global pharmacovigilance market on the basis of the product life cycle, service provider, type, process flow, therapeutic area, end-use, and region:

Based on the Service Provider Insights, the market is segmented into In-house, Contract Outsourcing.

- Contract outsourcing held the largest share of over 55.0% in 2021 and is expected to witness the fastest growth in the forthcoming years.

- The growth can be attributed to the benefits associated with outsourcing such as risk mitigation, resource flexibility, reduction of upfront investments, and lower fixed cost. Contract outsourcing organizations provide solutions such as process design Standard Operating Procedure (SOP), PV audits, and other customized services.

- The dynamic growth of the contract outsourcing segment can also be attributed to the rapidly emerging CROs providing end-to-end clinical trial solutions, especially in the emerging economies of Asia Pacific, such as India, China, and Japan, enabling resources sharing, cost efficiency, resource flexibility, and the expansion of operative capabilities.

- Contract outsourcing also helps reduce the complexity of clinical trials, allows faster approval of trials, and helps effective utilization of internal resources.

- The in-house segment is anticipated to witness moderate growth over the forecast period as a consequence of extensive R&D for the development of new drugs by major pharmaceutical and biotechnological companies.

Based on the Product Life Cycle Insights, the market is segmented into Pre-clinical, Phase I, Phase II, Phase III, Phase IV.

- The phase IV (post-marketing) segment led the overall market with a revenue share of over 75.0% in 2021. These solutions act as an additional safety measure for the drugs undergoing clinical trials. Phase IV is an imperative stage of clinical trials as unsuspected adverse drug reactions can be detected in this stage.

- The phase III segment is expected to witness lucrative growth over the forecast period. Phase III trials are done to determine and establish the efficacy of drugs. These trials also provide additional information regarding possible drug interactions, drug safety, and effectiveness before the commercialization of the drug.

Based on the Type Insights, the market is segmented into Spontaneous Reporting, Intensified ADR Reporting, Targeted Spontaneous Reporting, Cohort Event Monitoring, EHR Mining.

- Spontaneous reporting held the largest share of over 30.0% in 2021 owing to wide usage in the detection of new, serious, and rare ADRs and serves as an efficient and inexpensive method. The wide usage of surveillance reports generated through this method by pharmaceutical industries and regulatory authorities is also responsible for the significant growth of the segment.

- Cohort Event Monitoring (CEM) emerged as the second-largest segment in 2021 owing to the increasing application in the detection of a wide range of adverse clinical events.

- Targeted spontaneous reporting is projected to be the fastest-growing segment over the forecast period owing to the rising government initiatives to incorporate reporting methodologies other than spontaneous reporting by the European Network of Centers for Pharmacoepidemiology and Pharmacovigilance (ENCePP).

- Electronic Health Record (EHR) mining is increasingly used to identify risk factors for patients after discharge from hospitals. Electronic health records are imperative sources of medical information about clinical events in hospitals and research organizations.

Based on the Therapeutic Area Insights, the market is segmented into Oncology, Neurology, Cardiology, Respiratory Systems, Others.

- The oncology segment held the largest revenue share of over 25.0% in 2021. Monitoring the safety of cancer drugs is very important due to the associated side effects, which is propelling the demand for pharmacovigilance services. The drugs mostly have intrinsic biological toxicity and a narrow therapeutic window, which can lead to serious adverse reactions in the body.

- Pharmacovigilance helps in the early detection and spontaneous reporting of adverse drug reactions. Moreover, recent advancements in cancer treatments, such as targeted therapy, have some serious adverse effects and can compromise a patient’s quality of life.

Based on the Process Flow Insights, the market is segmented into Case Data Management, Signal Detection, Risk Management System.

- Signal detection dominated the market with a revenue share of over 35.0% in 2021. Spontaneous Reporting Systems (SRSs) use the dominant source of signals through which the suspected cases get voluntarily reported by the healthcare professionals to the other regulatory bodies.

- Nowadays, Artificial Intelligence (AI) and big data are being used by companies for better assessment of signals. The case data management segment is expected to exhibit the fastest growth rate over the forecast period. The adverse event information can be generated from various modes such as post-marketing programs, clinical trials, spontaneous reports, and literature.

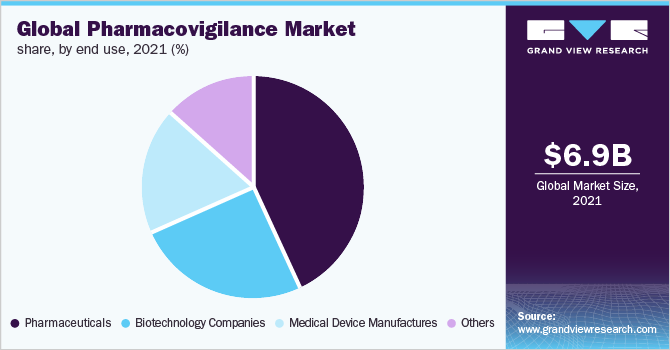

Based on the End-use Insights, the market is segmented into Pharmaceuticals, Biotechnology Companies, Medical Device Manufacturers, Others.

- The pharmaceuticals held the largest revenue share of over 40.0% in terms of revenue in 2021.

- Outsourcing the pharmacovigilance process is practiced by pharma companies to avoid high upfront investments and fixed overhead costs, increase resource flexibility, and secure additional capacity. Outsourcing pharmacovigilance proves to be a cost-effective endeavor for small and medium-sized companies.

- The biotechnology segment is anticipated to witness lucrative growth in the forthcoming years owing to increasing new product development activities in this sector. In recent years, drugs are being developed and consumed at increasingly high rates.

Pharmacovigilance Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is witnessing a significant boost owing to the patent expiration of branded drugs and the increasing number of new drug developments. This has attracted several local and international pharmacovigilance service providers. The presence of a competitive milieu has led to improved clinical data management and has streamlined the R&D process.

Some prominent players in the global pharmacovigilance market include

- Accenture

- Linical Accelovance

- Cognizant

- Laboratory Corporation of America Holdings

- IBM Corporation

- ArisGlobal

- ICON plc.

- Capgemini

- ITClinical

- FMD K&L

- IQVIA

- TAKE Solutions Ltd.

- PAREXEL International Corporation

- BioClinica Inc.

- Wipro Ltd.

- United BioSource Corporation

Order a free sample PDF of the Pharmacovigilance Market Intelligence Study, published by Grand View Research.