Global female infertility industry data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research along with a digital healthcare statistics e-book.

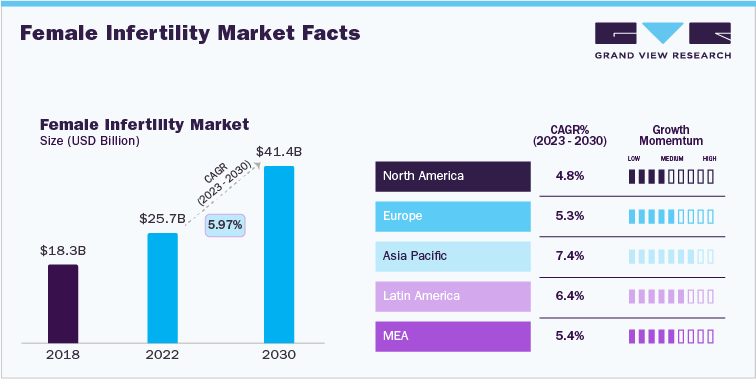

The global female infertility market size was valued at USD 25.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.97% from 2023 to 2030.

In Vitro Fertilization Market Growth & Trends

The global In-Vitro Fertilization (IVF) market size was valued at USD 23.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.72% from 2023 to 2030. This can be attributed to higher success rates and the introduction of advanced technologies, such as Percutaneous Epidydimal Sperm Aspiration and Testicular Sperm Extraction (PESA & TESE), three-parent IVF, mini-IVF, and others. Moreover, an increase in government funding for IVF is expected to boost segment growth over the forecast period. For instance, in May 2022, in Australia, under NSW Government 2022-23 budget, women in New South Wales opting for IVF will be provided with a USD 2,000 cash rebate to reduce the costs of the treatment for patients.

Fertility clinics and hospitals are key end-use segments analyzed in this study. Fertility clinics accounted for the maximum share of the market in 2022 and will continue to dominate the market during the forecast period, being the most preferred setting for physicians and surgeons. Licensed fertility clinics offer counseling to couples facing problems in conceiving. Based on the severity of their problems, doctors and specialists plan their IVF treatment. The IVF treatments offered by hospitals are generally more expensive than fertility clinics. IVF treatments require highly skilled physicians and staff. Hence, employing dedicated staff for IVF in hospitals is a less preferable approach.

Artificial Insemination Market Growth & Trends

The global artificial insemination market is valued at USD 2.1 billion as of 2022 and is expected to expand at a CAGR of 8.58% for the forecast period 2023-2030. This can be majorly attributed to the demand for minor fertility treatments and lower costs of treatment compared to IVF. Intrauterine insemination is the preferable treatment among all types of artificial insemination procedures. The intrauterine mode of insemination involves placing the sperm sample directly in the uterus and yields higher pregnancy rates. It is a non-invasive technique and is preferred by most of the infertile couples.

The market’s growth is driven by the lower cost of treatment, which is more suitable for minor fertility conditions and same-sex couples or single women. As per Human Fertilization and Embryology Authority (HFEA), the success rate of artificial insemination per cycle ranges from 15.8% for women under 35 to 11% for women aged 35 to 39, and 4.7% for women aged 40 to 42. Over the first six cycles, more than half of the women who had IUI reported pregnancy.

IUI is preferred over other methods as it is noninvasive, affordable, can be easily performed, there are minimum risks involved, and is easy to train. The pregnancy rate by IUI is higher than that by other modes of insemination.

Order your copy of Free Sample of “Female Infertility Industry Data Book - In Vitro Fertilization (IVF) and Artificial Insemination Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Competitive Landscape

Key players operating in the Female Infertility Industry are –

• Ferring B.V.

• Vitrolife AB

• CooperSurgical, Inc.

• Cosmos Biomedical Ltd.

• Merck KGaA

• Cryolab Ltd.

• FUJIFILM Irvine Scientific

• Bloom IVF Centre

• Microm UK Ltd.

• OvaScience

• Irvine Scientific

• Progyny, Inc.

• EMD Serono Inc.

• Thermo Fisher Scientific Inc.

• Boston IVF

No comments:

Post a Comment