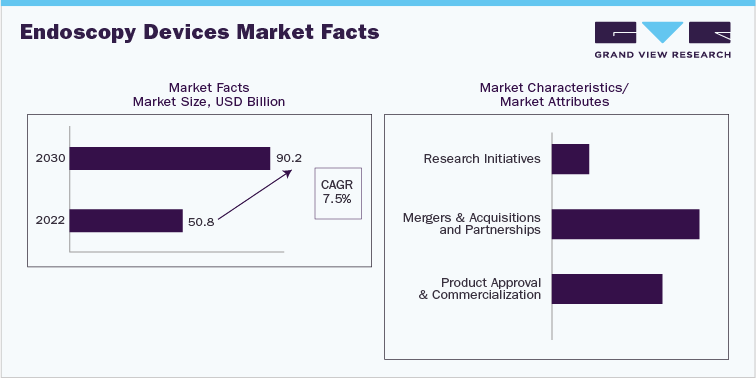

Global endoscopy devices industry data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research along with an endoscopy devices statistics e-book.

Access the Global Endoscopy Devices Industry Data Book from 2023 to 2030, compiled with details by Grand View Research

Endoscopes Market Insights

The global endoscopes market was valued at USD 18.8 Billion in 2022 and is anticipated to grow at a CAGR of 9.0% over the forecast period. It is expected to grow at a compound annual growth rate (CAGR) of 9.0% from 2023 to 2030. Growing awareness levelsabout minimally invasive surgical procedures and the increasing prevalence of chronic disorders are the major factors accelerating the market growth. The benefits, such as less surgery-related blood loss, no muscle cutting, and quicker recovery, offered by minimally invasive surgeries boost the adoption of endoscopic procedures over traditional/open-invasive surgeries. In addition, advancement in endoscopic technology and the rapid increase of its application to diagnose and treat various diseases are other key factors anticipated to propel the market growth over the forecast years.

The flexible endoscopes product segment dominated the market in 2022. This is attributed to the high demand for these devices on account of their unique features, such as the ability to reach viscera & cavities, better safety & efficiency, and improved ergonomic features. These devices are most commonly used in several endoscopic procedures, such as esophagogastroduodenoscopy (OGD), bronchoscopy, sigmoidoscopy, laryngoscopy, pharyngoscopy, nasopharyngoscopy, rhinoscopy, and colonoscopy procedures, which supports the product demand and segment growth.In 2022, the outpatient facilities end-use segment dominated the market. Increasing adoption of endoscopes across outpatient facilities, such as ambulatory surgery centers (ASCs) and diagnostic clinics, for the early diagnosis and detection of several life-threatening diseases is supporting the segment's growth.

Endoscopy Visualization Component Market insights

The global endoscopy visualization component market was valued at USD 6.7 Billion in 2022 and is anticipated to grow at a CAGR of 7.0% over the forecast period. Significant increase in the number of endoscopic procedures and increasing preference for minimally invasive surgeries are major factors contributing to the expansion of the market. Owing to the advantages of endoscopy over open surgeries, significant cost savings, and favorable government reimbursement policies, the demand for endoscopy is increasing. This coupled with the rapid adoption of advanced diagnostic tools has created a need for advanced visualization techniques. As a result, various manufacturers are focusing on introducing systems and components with better visualization capabilities. For instance, in September 2020, PENTAX Medical, a division of Hoya Corporation announced the launch of J10 Series Ultrasound Video Gastroscopes that offers renowned image quality and enhanced mobility.

The endoscopy visualization systems segment is estimated to dominate the market throughout the forecast period. Endoscopy is being widely used in various medical specialties such as gastroenterology, urology, gynecology, pulmonology, ENT, and others. Rising usage of high definition systems and increasing prevalence of cancer are factors favoring the growth of the segment. According to the WHO, the number of new bladder cancer cases is projected to rise from 573,000 in 2020 to 767,000 by 2030. Furthermore, rising government initiatives for newborns hearing screening are expected to drive the growth of the segment.

Order Free Sample Copy of Endoscopy Devices Industry Data Book, published by Grand View Research

Endoscopy Visualization System Market Insights

The global endoscopy visualization system market was valued at USD 16.7 Billion in 2022 and is anticipated to grow at a CAGR of 6.8% over the forecast period. Significant increase in the number of endoscopic procedures and increasing preference for minimally invasive surgeries are major factors contributing to the expansion of the market. Owing to the advantages of endoscopy over open surgeries, significant cost savings, and favorable government reimbursement policies, the demand for endoscopy is increasing. This coupled with the rapid adoption of advanced diagnostic tools has created a need for advanced visualization techniques. As a result, various manufacturers are focusing on introducing systems and components with better visualization capabilities. For instance, in September 2020, PENTAX Medical, a division of Hoya Corporation announced the launch of J10 Series Ultrasound Video Gastroscopes that offers renowned image quality and enhanced mobility.

The endoscopy visualization systems segment is estimated to dominate the market throughout the forecast period. Endoscopy is being widely used in various medical specialties such as gastroenterology, urology, gynecology, pulmonology, ENT, and others. Rising usage of high definition systems and increasing prevalence of cancer are factors favoring the growth of the segment. According to the WHO, the number of new bladder cancer cases is projected to rise from 573,000 in 2020 to 767,000 by 2030. Furthermore, rising government initiatives for newborns hearing screening are expected to drive the growth of the segment.

Endoscopy Operative Devices Market Insights

The global endoscopy operative devices market was valued at USD 8.6 Billion in 2022 and is anticipated to grow at a CAGR of 5.7% over the forecast period. It is expected to expand at a CAGR of 5.1% from 2021 to 2028. The rising prevalence of chronic diseases, surging demand for minimally invasive procedures, and increasing technological advancement in endoscope systems are the key factors aiding the market growth. An increase in the preference for keyhole or minimally invasive surgeries due to shortened hospitalization reduced post-operative complications, and decreased blood loss during surgeries is expected to fuel the market growth. The growing geriatric population burdened with chronic diseases is rapidly increasing across the globe and is a potential consumer base for endoscopes. This is likely to significantly drive the market over the forecast period.

The rising prevalence of gastrointestinal, respiratory, urological, and gynecological disorders, wherein endoscope systems are used to diagnose and treat the ailment, is expected to significantly contribute to the market growth. The growing prevalence of cancer and obesity across the globe is expected to drive the demand for endoscopy operative devices. For instance, the introduction of endoscopic bariatric surgeries as preventive measures is contributing to the growing demand. Similarly, laryngoscopy, colonoscopy, and upper endoscopy are used to diagnose lung, colorectal, and breast cancers. In addition, owing to an anticipated increase in demand for diagnostic and surgical procedures, the market is poised to grow at a higher rate from the first quarter of 2021.

Go through the table of content of Endoscopy Devices Industry Data Book to get a better understanding of the Coverage & Scope of the study.

Endoscopy Devices Industry Data Book Competitive Landscape

Increasing demand for endoscopy devices is increasing competition in the market and, thus, forcing key players to introduce new products in the market. Additionally, it is projected that rising industry consolidation activities, such as acquisitions and mergers by the leading market participants, as well as expanding efforts in R&D of endoscopy device applications by key players, are also expected to boost the market share.

Key players operating in the endoscopy devices industry are –

• Olympus Corporation

• Ethicon Endo-surgery, LLC.

• FUJIFILM Holdings Corporation

• Stryker Corporation

• Boston Scientific Corporation

• Karl Storz GmbH & Co. KG

• Smith & Nephew Inc.

• Richard Wolf GmbH

• Medtronic Plc (Covidien)

• PENTAX Medical

• Machida Endoscope Co., Ltd

No comments:

Post a Comment